Robert Kiyosaki’s groundbreaking work, “Rich Dad Poor Dad,” consistently sparks financial discussions, and its digital accessibility, particularly as a PDF, fuels widespread interest. Numerous online searches for “rich dad poor dad filetype:pdf” demonstrate a strong desire for convenient access to this influential text.

The book’s core principles regarding financial literacy and wealth building are readily available in various digital formats, including easily downloadable PDF versions, catering to a broad audience seeking financial empowerment.

Overview of the Book’s Core Message

“Rich Dad Poor Dad” fundamentally challenges conventional wisdom regarding money and emphasizes the crucial distinction between assets and liabilities. Kiyosaki advocates for acquiring assets that generate income, rather than accumulating liabilities that drain finances. The book’s central tenet revolves around financial education, urging readers to understand accounting, investing, and the markets.

It highlights the importance of building a strong financial foundation through entrepreneurial ventures and intelligent investments, moving beyond the traditional employment-based mindset. The narrative, contrasting the advice of his “rich dad” and “poor dad,” illustrates how financial intelligence can lead to wealth creation and financial freedom. The readily available PDF versions amplify this message, making it accessible to a wider audience seeking to reshape their financial futures.

The Popularity of PDF Versions

The widespread availability and convenience of PDF versions significantly contribute to the enduring popularity of “Rich Dad Poor Dad.” Online searches for “rich dad poor dad filetype:pdf” consistently yield numerous results, demonstrating a strong user preference for this digital format. PDFs offer portability, allowing readers to access the book on various devices – smartphones, tablets, and computers – without requiring a physical copy.

This accessibility lowers barriers to entry for individuals seeking financial education, particularly those who may not have immediate access to bookstores or prefer digital consumption. The ease of sharing PDFs, while raising copyright concerns, also contributes to its viral spread and continued relevance in personal finance discussions.

Understanding the Two “Dads”

Kiyosaki contrasts the financial philosophies of his biological “Poor Dad” and his friend’s “Rich Dad,” illustrating differing perspectives on money and wealth creation.

The “Poor Dad” Mindset

Kiyosaki’s “Poor Dad” embodies a traditional, yet limiting, financial perspective, prioritizing job security and a conventional path to wealth. This mindset centers around working for money, fearing debt, and believing that a high-paying job is the key to financial stability.

He emphasizes the importance of saving money, but lacks the understanding of making money work for you through investments and asset acquisition. The “Poor Dad” character consistently advises focusing on academic achievements to secure a good job, rather than developing financial intelligence and entrepreneurial skills. This approach often leads to a “rat race” of working to pay bills, without building lasting wealth or financial freedom, a core concept explored within the PDF versions of the book.

The “Rich Dad” Mindset

In stark contrast, the “Rich Dad” represents a proactive and financially intelligent approach to wealth creation. This figure advocates for acquiring assets that generate income, understanding financial statements, and leveraging debt strategically – concepts readily accessible when exploring the “rich dad poor dad filetype:pdf” online.

He champions entrepreneurship, investing, and continuous financial education, believing that money should work for you, not the other way around. The “Rich Dad” encourages taking calculated risks, learning from failures, and building a strong financial foundation through knowledge and asset ownership. This mindset prioritizes financial independence and escaping the traditional employment cycle, a philosophy detailed within the widely circulated PDF copies of the book.

Key Financial Concepts from the Book

“Rich Dad Poor Dad,” often found as a “rich dad poor dad filetype:pdf” download, introduces vital concepts like assets, liabilities, and financial intelligence for wealth building.

Asset vs. Liability

Robert Kiyosaki, in “Rich Dad Poor Dad” – frequently sought as a “rich dad poor dad filetype:pdf” – fundamentally redefines how we perceive assets and liabilities. Traditionally, many consider a house an asset, but Kiyosaki argues it’s often a liability due to ongoing expenses like mortgage, taxes, and maintenance.

Assets, according to the book, put money into your pocket, whether through income, appreciation, or reduced expenses. Examples include stocks, bonds, real estate that generates income, and intellectual property. Conversely, liabilities take money out of your pocket, like loans, credit card debt, and that aforementioned mortgage if it outweighs the income generated.

Understanding this distinction is crucial; the wealthy focus on acquiring assets, while the poor and middle class often accumulate liabilities believing they are building wealth. This core concept is repeatedly emphasized throughout the book and its various digital iterations.

The Importance of Financial Literacy

A central tenet of “Rich Dad Poor Dad,” widely available as a “rich dad poor dad filetype:pdf” download, is the critical importance of financial literacy. Kiyosaki argues that traditional education fails to equip individuals with the essential skills to manage money effectively, leading to a cycle of financial struggle.

He stresses understanding accounting, investing, markets, and the law – knowledge often reserved for the wealthy. Without this literacy, people remain employees, trading time for money, rather than building assets that generate passive income. The book advocates for actively learning about finances, questioning conventional wisdom, and taking control of one’s financial future.

Financial literacy isn’t merely about earning more; it’s about understanding how money works and making it work for you, a concept repeatedly highlighted in the book’s accessible format.

Mind Your Own Business

A provocative yet crucial lesson from “Rich Dad Poor Dad,” frequently accessed as a “rich dad poor dad filetype:pdf,” is the concept of “Mind Your Own Business.” This doesn’t imply selfishness, but rather focusing on building and acquiring assets – your own business – rather than solely relying on a job or someone else’s enterprise.

Kiyosaki emphasizes that the rich don’t work for money; they have money work for them. This is achieved by investing in assets that generate income, like real estate, stocks, or businesses. He cautions against the trap of endlessly working to support someone else’s dream, urging readers to prioritize building their own financial foundation.

Essentially, “Mind Your Own Business” is about taking ownership of your financial destiny and actively creating wealth, a core principle detailed within the book’s readily available digital version.

Finding “Rich Dad Poor Dad” PDFs Online

Searching “rich dad poor dad filetype:pdf” reveals numerous online sources, but caution is vital due to copyright concerns and potential security risks.

Legitimate Sources for PDF Downloads

Obtaining a legal PDF copy of “Rich Dad Poor Dad” ensures you support the author and avoid potential malware risks associated with unofficial sites. While a completely free, legally sanctioned PDF is rare, several avenues offer legitimate access.

Robert Kiyosaki’s official website, www.richdad.com, frequently promotes the book and may offer promotional downloads or links to authorized retailers. Major e-book retailers like Amazon Kindle, Google Play Books, and Apple Books sell the digital version, often available for immediate download as a PDF compatible file.

Furthermore, some online libraries and educational platforms, with appropriate subscriptions, may provide access to the book in PDF format. Always verify the source’s authenticity before downloading to protect your device and respect copyright laws.

Risks of Downloading from Unofficial Sites

Seeking a free “Rich Dad Poor Dad PDF” from unverified websites carries significant risks. These sites often host malicious software, including viruses, malware, and spyware, which can compromise your device and personal data. Downloading from such sources exposes you to potential identity theft and financial fraud.

Furthermore, many unofficial PDFs are illegally distributed, violating copyright laws. Downloading copyrighted material without authorization is unlawful and can result in legal consequences. The quality of these PDFs is often poor, containing formatting errors, missing pages, or even altered content.

Prioritize your digital security and legal compliance by avoiding these risky downloads. Opt for legitimate sources, even if they require a purchase, to ensure a safe and authentic reading experience.

Copyright Considerations and Legal Downloads

“Rich Dad Poor Dad” is protected by copyright, meaning unauthorized reproduction and distribution, like many free “rich dad poor dad filetype:pdf” offerings, are illegal. Respecting copyright ensures Robert Kiyosaki and the publishers are fairly compensated for their work, fostering continued financial literacy resources.

Legal download options include purchasing the eBook from reputable retailers like Amazon Kindle, Google Play Books, or Apple Books. These platforms guarantee authentic, high-quality versions of the book. Additionally, consider borrowing the eBook from digital libraries, offering a legitimate and cost-effective access method.

Supporting legal channels protects authors and encourages the creation of valuable financial education materials; Avoid contributing to copyright infringement by choosing authorized sources for your digital copy.

Analyzing the Book’s Impact

“Rich Dad Poor Dad” profoundly impacted personal finance, challenging conventional wisdom, and inspiring millions to pursue financial independence, even via PDF access.

Influence on Personal Finance

Robert Kiyosaki’s “Rich Dad Poor Dad” dramatically altered the landscape of personal finance literature, shifting focus from traditional saving to asset acquisition and financial literacy. The book’s core message – understanding the difference between assets and liabilities – resonated deeply, prompting individuals to re-evaluate their financial strategies.

The widespread availability of the book, including easily accessible PDF versions found through searches like “rich dad poor dad filetype:pdf”, amplified its reach. It encouraged readers to question conventional financial advice, explore entrepreneurial ventures, and prioritize financial education. This influence extends to inspiring a generation to seek alternative income streams and build wealth through investments, rather than relying solely on employment.

Furthermore, the book popularized concepts like cash flow management and tax advantages, empowering individuals to take control of their financial futures.

Criticisms and Controversies

Despite its immense popularity, “Rich Dad Poor Dad” has faced significant criticism. Some financial experts dispute Kiyosaki’s advice, arguing it oversimplifies complex financial situations and promotes potentially risky investment strategies. Concerns have been raised regarding the veracity of the “Rich Dad” character and the anecdotal nature of the book’s teachings.

The ease of finding PDF versions online – through searches like “rich dad poor dad filetype:pdf” – has also contributed to the spread of unverified information and potentially misleading interpretations of the book’s concepts. Kiyosaki himself has faced scrutiny for past business ventures and bankruptcy filings, leading to questions about his financial expertise.

Critics also point to a lack of specific, actionable advice, favoring broad philosophical principles over concrete financial planning guidance.

The Book’s Continued Relevance in 2025

Even in 2025, “Rich Dad Poor Dad” maintains a strong resonance, fueled by ongoing economic uncertainties and a growing interest in financial independence. The accessibility of the book, particularly through readily available PDF downloads found via searches like “rich dad poor dad filetype:pdf”, ensures its continued reach to new generations.

Its core message – emphasizing financial literacy, asset acquisition, and challenging conventional wisdom about money – remains powerfully relevant in a rapidly changing economic landscape. The book’s focus on building passive income streams and escaping the “rat race” appeals to individuals seeking alternative paths to financial security.

Despite criticisms, the book continues to spark crucial conversations about money management and wealth creation, solidifying its place as a foundational text in personal finance.

“Rich Dad Poor Dad” and Digital Formats

Robert Kiyosaki’s book thrives in digital spaces, with convenient PDF access via searches like “rich dad poor dad filetype:pdf”, alongside e-books and audiobooks.

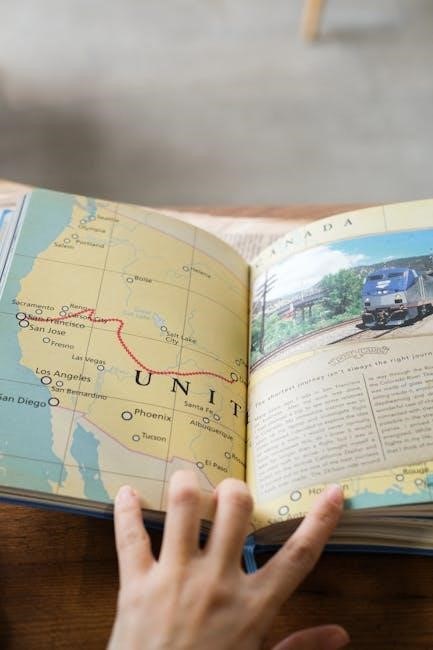

E-book Availability Beyond PDF

While the search term “rich dad poor dad filetype:pdf” highlights the popularity of PDF versions, the book extends far beyond this single format. Numerous platforms offer “Rich Dad Poor Dad” as a dedicated e-book, compatible with a wide array of e-readers like Kindle, Kobo, and Apple Books.

These e-book editions often provide enhanced features compared to simple PDFs, including adjustable font sizes, built-in dictionaries, and the ability to highlight and annotate passages. Purchasing through official e-book retailers ensures a legitimate copy and supports the author. Furthermore, many online bookstores provide samples, allowing potential readers to preview the content before committing to a purchase. The accessibility of the book in multiple e-book formats significantly broadens its reach and caters to diverse reading preferences.

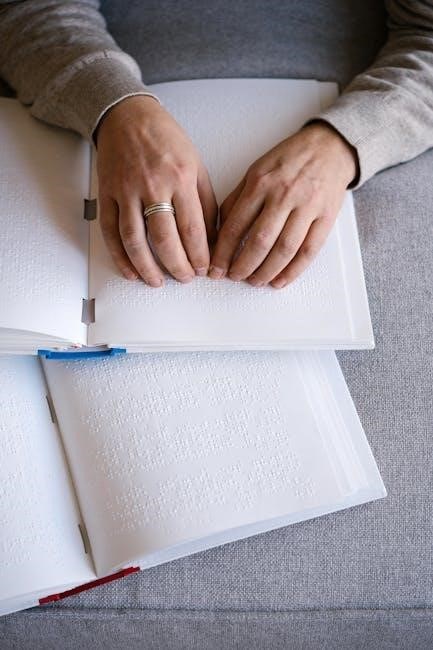

Audiobook Options and Accessibility

Beyond e-books and PDFs, “Rich Dad Poor Dad” is widely available as an audiobook, offering a convenient learning experience for those on the go or who prefer auditory learning. Platforms like Audible, Google Play Books, and Apple Books host multiple versions, often narrated by different voice actors.

This format enhances accessibility, allowing listeners to absorb the book’s financial principles during commutes, workouts, or household chores. The audiobook format can be particularly beneficial for individuals with visual impairments or reading difficulties. Searching for “rich dad poor dad filetype:pdf” often leads users to discover these alternative formats as well, demonstrating a growing demand for versatile consumption options. Audiobooks provide a dynamic and engaging way to experience Kiyosaki’s teachings.

The Convenience of Digital Consumption

The proliferation of digital formats, including the sought-after “rich dad poor dad filetype:pdf,” underscores a significant shift in how readers access and engage with financial literature. Digital consumption offers unparalleled convenience – instant access, portability across devices, and the ability to search and highlight key passages.

Unlike physical copies, digital versions eliminate the need for storage space and allow for immediate download. This accessibility is particularly appealing to a global audience seeking to improve their financial literacy. The ease of sharing (within legal boundaries) and the lower cost compared to hardcovers further contribute to the popularity of digital formats. This convenience fuels the ongoing demand for readily available PDF versions and e-books.

Exploring Related Resources

Robert Kiyosaki’s additional works and numerous financial education websites complement “Rich Dad Poor Dad,” offering deeper insights and tools for wealth building.

Robert Kiyosaki’s Other Works

Robert Kiyosaki has expanded upon the foundational principles of “Rich Dad Poor Dad” with a series of subsequent books, offering more detailed strategies for financial independence. Cashflow Quadrant explores different avenues for income generation, categorizing individuals based on their financial approach – employee, self-employed, business owner, or investor.

Guide to Investing delves deeper into investment strategies, providing practical advice on real estate, stocks, and other asset classes. Rich Dad’s Conspiracy of the Rich examines the systemic flaws in traditional financial education. Furthermore, Kiyosaki’s work extends to include board games like Cashflow 101, designed to simulate real-world financial scenarios and enhance financial literacy through interactive learning. These resources collectively build upon the core message of achieving financial freedom.

Financial Education Websites and Tools

Numerous online platforms complement the lessons found in “Rich Dad Poor Dad,” offering accessible financial education. Investopedia provides a comprehensive glossary of financial terms and in-depth articles on investing strategies. Khan Academy offers free courses covering personal finance basics, from budgeting to retirement planning.

NerdWallet delivers comparisons of financial products like credit cards and loans, aiding informed decision-making. Mint and Personal Capital are popular budgeting and wealth tracking tools, enabling users to monitor their finances effectively. Furthermore, several YouTube channels, such as “The Financial Diet,” present financial concepts in an engaging and relatable manner. These resources empower individuals to take control of their financial futures, building upon the principles outlined in Kiyosaki’s work.

Communities and Forums for Discussion

Engaging with fellow readers enhances the learning experience from “Rich Dad Poor Dad.” Reddit’s r/personalfinance and r/financialindependence subreddits host vibrant discussions on wealth building and investment strategies, often referencing Kiyosaki’s principles. BiggerPockets is a popular forum specifically for real estate investors, aligning with the book’s emphasis on asset acquisition.

Quora features numerous threads where users analyze the book’s concepts and share their personal experiences. Facebook groups dedicated to “Rich Dad Poor Dad” provide spaces for collaborative learning and networking. These online communities foster a supportive environment for individuals to ask questions, share insights, and collectively navigate the path towards financial freedom, extending the book’s impact beyond its pages.